What finance options are there for small businesses?

Not sure which finance route is right for you? Finance Hub walks you through the most popular types of finance these days.

Getting a business loan may sound simple, but making sense of the many types of business finance options out there can be overwhelming, especially if you don't know what would be the best fit for your business.

Once you know the time is right and you've done all your preparation, it's time to start looking at your finance options, and matching them to your needs. Let's look at some of your potential funding options.

Asset finance

Asset finance helps your business to access the resources you need, like machinery, computers, office equipment or vehicles, with an agreed monthly repayment over a period of time, typically one to three years. Once you've paid off the loan, you then own the asset.

Property Funding

If you are looking to purchase or re-mortgage property or land for commercial use Finpoint can help. Property finance also covers a number of investment options and is geared towards supporting experienced property professionals in the areas of: residential property finance, commercial property finance, student accommodation finance or mixed-use property finance.

Working Capital

A working capital loan is a short-term loan that is taken out to facilitate the day-to-day running of everyday operations so that you can focus on business growth.

Use FSB Funding Platform search and compare lenders who specialise in working capital loans.

Invoice finance

Invoice finance is a way of borrowing money against unpaid invoices for a fee. Generally, the lender advances between 70% and 85% of the invoice value and will release the remaining amount minus a small fee once they get paid by your client, which can help to ease cash flow worries.

There are several types of invoice finance, including invoice factoring, invoice discounting or selective invoice finance (SIF), so it's worth weighing up your options to see which would suit your business best - our funding guide outlines this in more detail.

Trade finance

Trade finance is an important external source of working capital finance. It's a form of short-term credit typically used by companies that export or import goods. It is relatively easy to secure short term finance, if you have a strong trading record, secured against goods or backed by an insurance policy.

There are a number of banks and specialist finance providers on the FSB Funding Platform funder panel that offer trade finance across the world.

Recovery Loan Scheme

The Recovery Loan Scheme (RLS) provides financial support to businesses across the UK as they recover and grow following the coronavirus pandemic. You can apply to the scheme if Covid-19 has affected your business, is open until 30 June 2022, subject to review.

These are difficult times we find ourselves in. And, as was true before the COVID-19 crisis, there are no shortcuts when it comes to business finances. But FSB Funding Platform is doing what we can, to offer you a simple and easy way to access multiple providers for the RLS.

R&D Tax Credits fund

There is no such thing as a free lunch … unless … the government has its fingers in the pie. Research and development (R&D) tax credits are an HMRC initiative designed to support innovative businesses in science and technology.

FSB Funding Platform can help you find the most appropriate specialist - it doesn't take more than 10 minutes of your time to fill in our short, intuitive online form to check your eligibility.

Growth finance

Looking to expand your business and enter new markets? Whether you're developing new products, buying new equipment or embarking on new sales initiatives, growth finance can help you generate more revenue and profit.

However, you'll want to watch out for any early repayment fees, variable interest rates and the security arrangement on the loan.

Pension finance

Pension finance is a type of alternative finance. It sounds complicated, but it works like a business loan - money is borrowed from your personal pension(s) and paid back with interest by the business. You can raise funds based on the pensions accrued by one or more owners or directors.

However, as pensions are your retirement savings, it comes with risk as your pension pit isn't guaranteed to grow. Your borrowing limit is also dictated by your pension size.

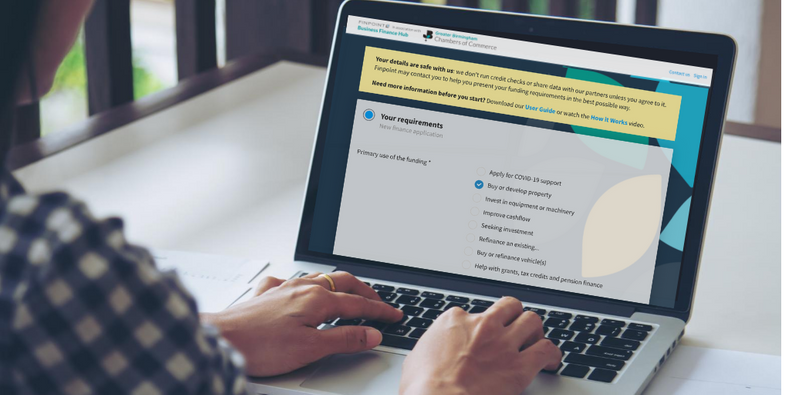

Ready to start your funding journey?

Whether you're looking to grow your business, make investments or support your cash flow, our finance experts at Finance Hub are here to guide you during the whole process.

As an GBCC member, you can save time and effort with one simple online application, and let our experts handle the rest. Get started with your application here.

APPLY here (for free and with no impact on your credit score!)